What is Insurtech and How are Insurers Using It

Insurance companies face many challenges, not only at the stage of client acquisition and retention but also at the stage of adjusting the offer and processing claims. From this article, you'll learn what insurtech is, why it's important for insurance organizations, what are the typical challenges and the hottest trends in this market.

Insurtech – definition

Insurtech is a concept that arose from the combination of the words „insurance" and „technology". It's easy to guess that it refers to the solutions that improve the work of insurers and to the companies that create these solutions. The products and services offered by this industry make life easier not only for insurance institutions but indirectly also for their clients, increasing the availability of insurance products.

Insurtech is dynamically growing, the same as fintech. The goal of insurtech organizations is to create and develop tools (systems and applications) to automate the work at insurance companies. Such programs have different functionalities. They are able to analyze clients' data, estimate risk and generate personalized offers, and even process claims for compensation.

The main purposes of applying insurtech software are:

- increasing the business flexibility,

- improving the process efficiency,

- better personalization of services and communication,

- reducing the risk related to cybercrime.

Advantages of insurtech solutions

The primary reason companies invest in innovative tools is to increase their business competitiveness and flexibility. However, building complex software on your own is costly. The dynamic development of the insurtech industry enables insurance institutions to achieve their goals and increase efficiency without the need to create such systems within the company. Instead, they can upgrade their processes with the automation software provided by insurtech, which improves the operation of the company and reduces its expenses. This not only translates into higher profits but also gives the opportunity to offer clients more competitive prices and services.

The use of modern systems allows insurers to extend their offer with personalized products, tailored to the individual needs of every client (e.g. insurance containing specific services from the assistance package or an extension of personal insurance with full coverage of medical bills).

Insurtech market size

According to the Global INSURTECH Market report, in 2020 the value of the insurtech market was evaluated at over USD 9 million and it's estimated that by 2030 it'll reach almost 159 million. The authors of the report inform that, according to the data provided by Accenture, in 2020 almost 86% of insurers planned to innovate and modify their business model to increase their competitiveness, and their main goal is to provide clients with more personalized services and experiences.

In turn, the Gallagher Re Global InsurTech Report for Q1 2022 shows that the investments in the insurtech industry in the first quarter of 2022 amounted to as much as USD 2.2 billion, which equates to 43% of total investments in this sector in 2021. This is a sign of dynamic development.

Research shows that insurance companies should take interest in insurtech and transforming their businesses if they want to retain their clients. As many as 41% of consumers think about changing their service provider due to insufficient options for using digital services. And 15% consider the lack of such options to be the industry's main problem. There are also numerous cases of reporting difficulties while purchasing insurance online.

What challenges are insurtech companies facing?

Every industry faces its inherent difficulties and more general problems related to customer service, promotional activities, etc. Insurtech faces challenges inherent in the financial industry and beyond. Many of them result from the ongoing digitization and the companies taking their business to the web.

Complying with regulations

The most difficult task is to ensure compliance with regulations, and the regulations (related to guaranteeing data security, company solvency, rates, and handling clients' claims) are many. It's challenging for both startups, which may not have adequate experience due to being established recently, and large companies, whose flexibility has decreased over the years, and whose size makes it difficult to quickly introduce the necessary changes. The solution may be the integration of regtech solutions (allowing for monitoring the changes in regulations, risk assessment, and generating reports), whose task is to track the changes in regulations and make it easier for various companies to achieve compliance of services with the introduced regulations.

Ensuring the cybersecurity

Cyberattacks occur every 11 seconds. In 2021, one insurance company lost approximately USD 40 million as a result of a cyberattack. The Cyber Insurance Risk in 2022 report published by Black Kite indicates that 82% of the largest insurers are vulnerable to phishing attacks (stealing sensitive information). The solution to this situation is the implementation of modern cybersecurity systems that constantly monitor the software of insurance companies, using artificial intelligence and automated risk assessment solutions.

Adapting services to the needs and expectations of clients

Insurance itself is not an easy-to-sell service. Users' trust in insurance companies isn't great. In addition, most institutions currently have a low level of offer personalization. To attract clients with their services, companies must meet their expectations. It's necessary to adapt the offer (and advertising messages) to the needs of the recipient. It's possible with the use of personalization, segmentation, advanced analytics based on artificial intelligence, and recommendation engines, as with the creation of an intuitive website or mobile application for the users.

Most important insurtech trends

Some insurtech trends coincide with the fintech industry trends. The most important are:

- Chatbots implementation. It's expected that 95% of clients' contact with an insurance company will be carried out via bots by 2025.

- Use of smart devices (smartwatches, bands, etc.). The number of users of electronic gadgets capable of gathering information is increasing, which allows assuming that in the future they'll likely be used to collect data for insurtech and to customize offers.

- Use of IoT sensors – 69% of users declare that they may consent to the installation of sensors in cars if it may affect the amount of their installments.

- Process automation. Automating certain processes may reduce the amount of repetitive work of an insurance agent by 80% and shorten the processing time of claims or applications by 50%, so the time may be used better and the clients may get a response faster.

- Use of big data and personalization. The clients' data from various sources and the segmentation make it possible to provide the client with a better experience (both in terms of service features and customer service).

Insurtech examples

There are many interesting ways to improve your work and create new services in the insurance industry. Below are some examples of the services and products that might be of use to your insurance company, as well as some real-world examples.

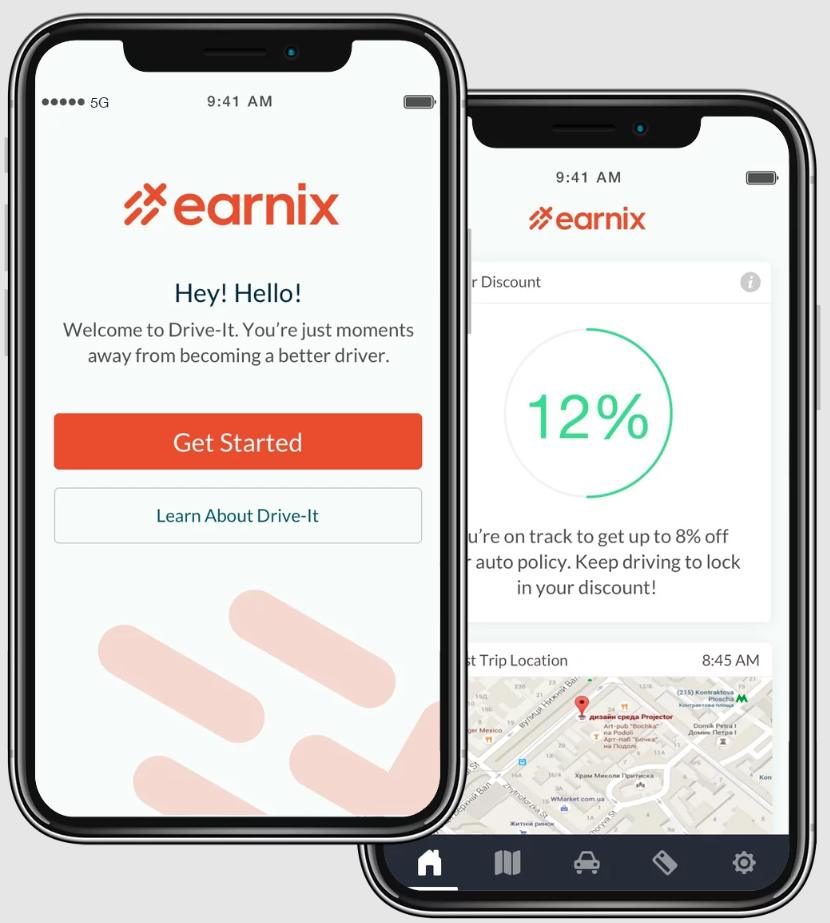

1. Car insurance software in the „pay-how-you-drive" model

A „pay-how-you-drive" (or „pay-as-you-drive) insurance is a model that depends on how the car is used. Under this concept, careful drivers should be able to pay a lower premium, while those driving in a risky or careless manner should pay higher insurance costs. Using this model requires consent to monitor the use of the car in order to evaluate the driving style and adjust the rate.

The Earnix company offers a solution that allows insurance organizations to gain access to the data on drivers' rides. This offer is aimed at insurance companies of any size. The application allows for accessing the data on drivers' behavior and automatically adjusts the insurance price. Other solutions provided by this company help, e.g. in processing claims for damages.

2. Automated handling of injured parties' claims

Analyzing clients' claims for compensation requires a lot of formalities, which makes the process rather time-consuming. In addition, there's always a risk of an insurance agent making a mistake, which may generate additional costs and have a negative impact on clients' experience and satisfaction. Insurtech companies come to the aid of insurance agencies, creating software capable of automatically verifying clients' applications and the documentation provided by them. This improves clients' satisfaction, speeds up the processing of applications, and reduces the company's costs.

Such solutions are created by both insurtech companies and enterprises that focus their efforts on creating software for various industries. The product of the Comarch brand, Comarch Insurance Claims, may be used as an example here. The system allows for the automated processing of claims (of a client or an intermediary) from the moment of registration, through performing calculations, to making a decision and paying compensation. Additional functionalities include automated handling of appeals, complaints, lawsuits, and refunds. It’s possible to integrate the software with external systems, operate it in different languages and for different currencies, as well as generate reports.

3. Peer-to-peer (P2P) insurances

Peer-to-peer is an insurance model that involves many entities joining forces to financially secure the business community they’ve created. Funding comes from the entities that joined the group and is granted on the basis of the conditions agreed by this group. Usually, such insurance is chosen by people or companies with certain common features, e.g. drivers of the same car brand. During the next step, the insurance products tailored to the members' needs are defined. What is the advantage of such a solution? In comparison to large insurance companies, such a group is smaller, and its members are interconnected by certain relationships and knowledge of their own needs, which ensures the creation of personalized insurance products.

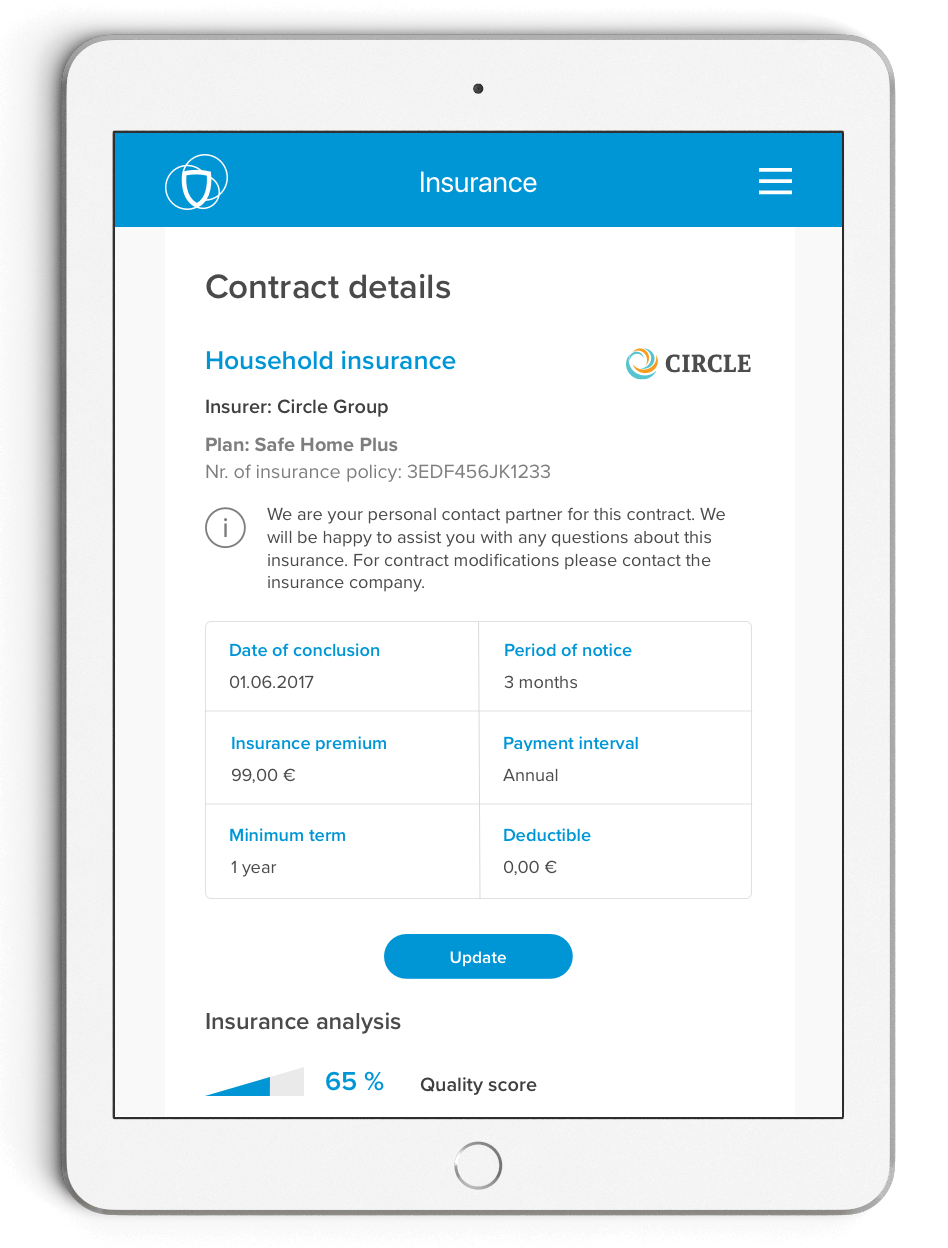

An example of a peer-to-peer service provider is the German company Friendsurance. It created a special platform for banks, insurance agencies, and partners wishing to take advantage of the services provided in this model. Friendsurance provides access to business intelligence tools and guarantees compliance with basic regulations such as PSD2 (the Revised Payment Services Directive). The system takes care of consumers' satisfaction by using a model that awards prizes in the form of annual bonuses for the clients who haven't submitted any claims in a given year.

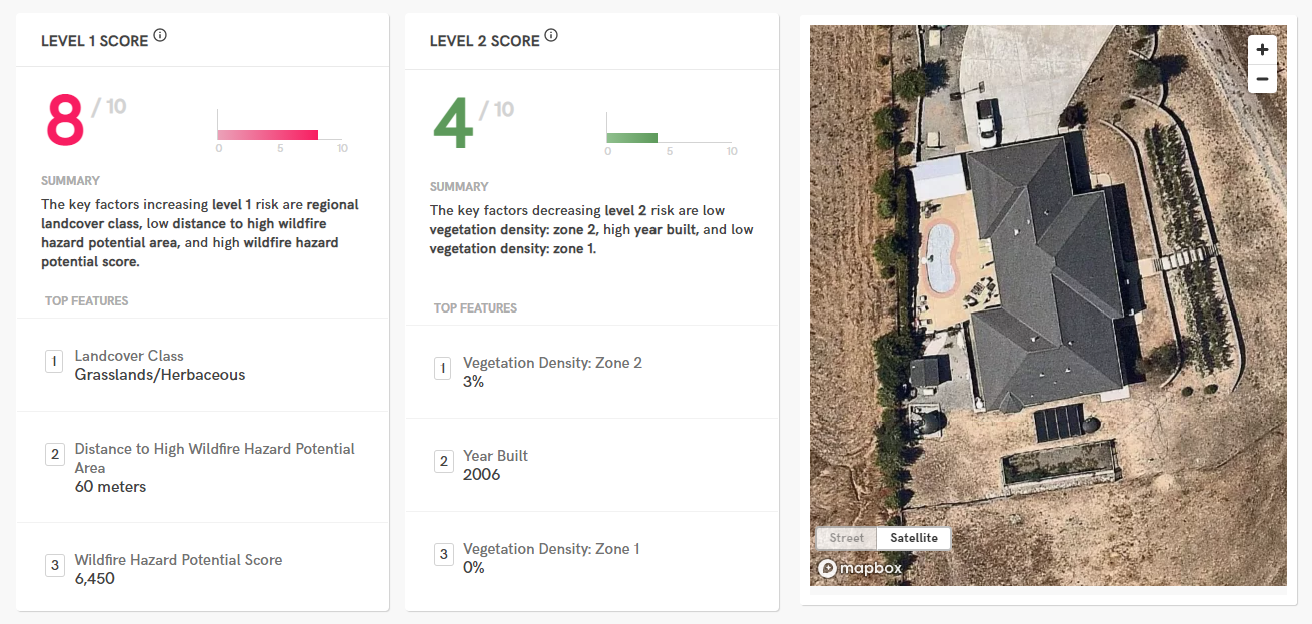

4. Risk assessment

Zetsy.ai is a company that developed modern software based on computer vision, artificial intelligence, and deep learning in order to monitor and assess the risks for the real estate insurance industry. The offered solutions allow insurance agencies to estimate the appropriate value of insurance and provide clients with efficient service. One of the products provides insurance companies with the results of a fire, flood, or hail risk assessment. They include a preview of the satellite image and an explanation of the results, which facilitates their analyses (like what increases the risk of a fire at the property). Another solution provides the user with relevant information (on building permits, public infrastructure in the area, weather, utility bills, etc.) about the property. Thanks to the knowledge the insurer can acquire in this way, it's possible to properly adjust the offer to the client's needs, while minimizing the business risk for the insurance company.

5. Efficient claim settlement

Claim settlement, or identifying the causes and determining the liability for damage, isn't an easy task. This process is based on estimating the scale of damage and leads to determining the amount of compensation.

The Bdeo company offers insurance agencies AI-powered solutions that simplify the process. It provides agencies and their clients with a chatbot using NLP (natural language processing), which identifies the location where the accident occurred, instructs clients on how to document the event (what to record), and how to upload the documentation to the system. If the uploaded data doesn't meet the quality standards, the chatbot notifies the client and accompanies them until they upload photos and recordings of proper quality. This reduces the likelihood of mis-assessing the damages and streamlines the overall processing of claims by insurers.

What is insurtech? Summary

Insurtech companies use the latest technology in a variety of ways to create products that facilitate the work of insurance companies. There are comprehensive, multi-functional programs on the market that combine many different tools. They include risk assessment systems, process automation tools, high-quality CRMs, and many more. We'd be happy to help you build a functional website for an insurance company and implement the insurtech solutions described in this article.